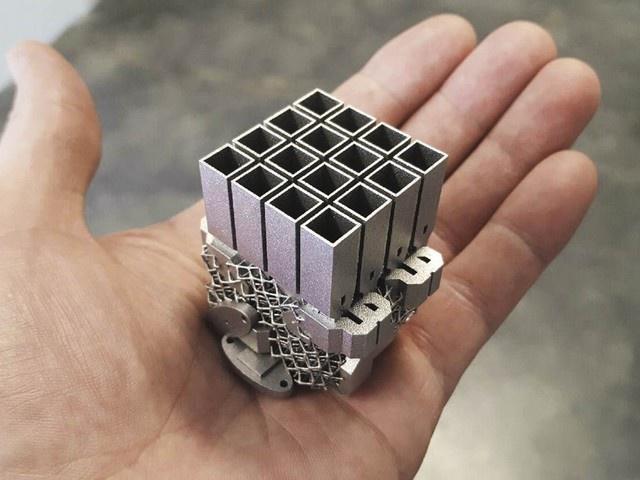

Industry analyst firm SmarTech Analysis has just released its latest report, arguing that the metal additive manufacturing industry is emerging from the 2018 challenge to generate nearly $3.3 billion in revenue, including 3D printers, materials and services. The company believes that 2019 is a strong year of rebound and that the revenue from the metal additive manufacturing market is expected to reach $11 billion in 2024.

The metal 3D printing market is expected to reach $11 billion in 2024.

SmarTech Report Analysis Expects Metallic 3D Printing Market to reach $11 billion in 2024

The latest issue of SmarTech's industry-leading metal additive manufacturing technology and materials market report identifies how the metal 3D printing market will evolve in three unique technology areas to unlock the familiar and emerging global digital manufacturing needs around the world.

The report provides resources to track new production applications for metal 3D printing last year, and details top companies in all areas of the market, while highlighting SmarTech's own long-term analysis of metal 3D printing technology in the future.

Well-known companies mentioned in the report include AP&C, Carpenter, Coherent, Desktop Metal, EOS, ExOne, GE Additive, Heraeus, Hoganas, HP, Markforged, Oerlikon, Praxair Surface Technologies, Sandvik, SLM Solutions, Stratasys, Tekna, Trumpf And Velo3D.

The metal 3D printing market is expected to reach $11 billion in 2024.

The metal 3D printing market grew rapidly in 2019

The new metal 3D printing process that will be launched by companies such as Desktop Metal, HP, Stratasys, and GE Additive will soon allow users to suspend investment in metal 3D printing and wait and see. At the same time, the rapid development and innovation of laser powder bed fusion technology SLM makes this technology in a better position in industrial manufacturing.

Overall, the powder bed fusion technology SLM still plays the most important role in metal 3D printing, accounting for 80% of the global metal 3D printer installed capacity. Although SLM metal 3D printer hardware revenue declined slightly in 2018, sales of metal 3D printing equipment increased significantly, and sales of new hot-melt deposition MDM technology metal 3D printing products soared.

In the long run, the growth of the metal 3D printing market also seems to depend on users to understand it in a very detailed and professional level. It is here that SmarTech believes that the “three Ss” will help to improve users' long-term use and purchase capabilities: software, services and standardization.

Copyright © 2017-2024 Nanjing Wiiking 3D Technology Co., Ltd. All rights reserved. Privacy & Security Policies